The office of County Treasurer was created by the N.D. Constitution and the duties are listed in Century Code. Treasurers are elected to four-year terms on a nonpartisan ballot during November elections and they officially assume duties in May. The salary is set by state statute and is based on the population of the county.

The county treasurer shall receive all moneys belonging to the county, from whatever source they may be derived, and all other moneys which by law are directed to be paid to the treasurer. The treasurer shall pay out moneys belonging to the county only on a properly drawn county warrant or in any other manner provided by law.

The county treasurer shall keep an accurate and detailed record of all moneys which shall come into the treasurer's hands by virtue of the treasurer's office.

The treasurer's office is used by taxpayers, state agencies, lending institutions and reality companies, to name a few. The treasurer's office provides easy access to tax and real estate records throughout the year to anyone who requests that information.

PAYING YOUR TAXES ONLINE

Paying Your Bill

You can pay your Property Taxes via MuniciPAY using:

- Check

- Cash

- Money Order

- Visa, MasterCard, Discover, American Express (service fee will apply, see below)

- Electronic Check Payments (service fee will apply, see below)

Credit Card Payments Made in Office or via Telephone

Divide County offers the convenience of accepting MasterCard, Discover, American Express and Visa credit cards for property taxes. The payment processing company charges a service fee of 2.65% or $3.00 minimum to cardholders who use this service. Just stop by our office or give us a call at 701-965-6312 to use your MasterCard, Discover Card, American Express or Visa.

Credit Card Payments Made Online

Now you can pay your Propert Taxesfrom the comfort of your home or office by using our online payment service. Credit cards accepted: MasterCard, Discover, American Express or Visa. A per transaction service fee of 2.65% or $3.00 minimum will be charged by the payment processing company for this service.

Electronic Check Payments

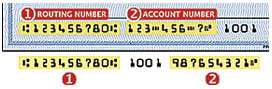

YOUR CITY/TOWN NAME now accepts electronic check payments using our online payment service. Payments will be charged to your checking or savings account at your bank. You will need your 9-digit routing number, as well as your account number from your personal checks (see example below). A per transaction service fee of $1.50 will be charged by the payment processing company for this service.

IMPORTANT: When Payment Options appears, click on the "Switch to Pay with Check" link and then continue entering your information.

DIVIDE COUNTY TAX PAYMENT SCHEDULE

All taxes become due on January 1st.

A 5% discount is allowed on the consolidated real estate taxes if thetotal tax statement is paid in full on or before February 15th.

The first payment consists of one half of the consolidated tax and the full amount of the yearly installment of special assessments as shown on the statement.

The first installment becomes delinquent after the first day of March.

If not paid on/or before March 1st, use the following penalty schedule:

MARCH 2nd ...................3 PERCENT

MAY 1st...........................6 PERCENT

JULY 1st..........................9 PERCENT

OCTOBER 15th.............12 PERCENT

The second payment consists of the remaining one-half of the consolidated tax. This installment becomes delinquent after October 15th.

If not paid on or before October 15th, use the following penalty schedule:

OCTOBER 16th..................6 PERCENT

An interest of 12% per annum will begin after January 1st.

PROPERTY TAXES CAN ONLY BE DELINQUENT FOR THREE YEARS BEFORE FORECLOSURE.

Understanding Property Taxes

This page is intended to help you understand property taxes in general. For specific questions regarding your property values or taxes, please contact your County Auditor or Tax Director. Contact information for all county officials can be found on our interactive map at www.ndaco.org/counties.

There are three “moving parts” involved in determining your property taxes:

- MILLS

- TAXABLE VALUES

- TAXING ENTITIES (or TAXING AUTHORITIES)

We hope the following questions and answers will help you understand what these terms mean and how each one affects your property tax bill.

MILLS

Question: What is a mill?

Answer: A “mill” is simply 1/1000th of anything:

- 1/1000th of one meter is a millimeter

- 1/1000th of one gram is a milligram

Question:Why not just use percentages?

Answer:Actually, a mill IS a percentage. Itis one tenth of 1 percent, or .1%.

- Percent means "per 100." Mills are "per 1000."

- Multiply X .01 to get percent. Multiply X .001 to get mill

Question: How much is a mill worth?

Answer: It depends...

As stated above, a mill is 1/1000th of something. On your property tax bill, that "something" is your TAXABLE VALUE. To answer the question, “How much is a mill worth?” you simply take 1/1000 (or .001) times your taxable value.

THE VALUE OF A MILL IS 1/1000th OF YOUR TAXABLE VALUE

TAXABLE VALUE

Taxable value is calculated by multiplying the “True and Full” value of your property times…

- 4.5% for residential property

- 5% for agricultural and commercial property

For example, a home that is worth $200,000.00 has a taxable value of $9,000.

$200,000 X 4.5% = $9,000

Remember, the value of one mill is 1/1000th of the taxable value, so in this case, one mill is $9.

(Another term you may hear related to property taxes is “Assessed Value” which is simply ½ of your True and Full value.)

TAXING ENTITIES

When you pay your property tax bill, you are actually paying taxes to several different TAXING ENTITIES or AUTHORITIES. These are your various forms of local government, including your county, city, township, school board, park board and any other entity that is authorized to levy property taxes.

The example below is not intended to be typical, but demonstrates the point in round figures:

| TAXING ENTITY |

MILLS |

| School District |

115 |

| County |

60 |

| City |

40 |

| Township |

10 |

| Park District |

15 |

| Water District |

5 |

| Library Board |

1 |

| Rural Fire/Ambulance |

3 |

| UND Medical School* |

1 |

| TOTAL |

250 |

You probably wouldn’t want to get each a separate tax bill from each of those entities, so you get one property tax bill from your county, and the county distributes your payment to each of the other entities. These different entities are governed by different elected officials. Not everyone in the county lives in the same city (or in a city at all), nor do they all live in the same school district or park district. North Dakotan's value their right to elect their representatives to the school board, county commission, city commission, etc.

PUTTING IT ALL TOGETHER

To combine our two examples above, the NUMBER of mills (250) times the VALUE of each mill ($9) is the total tax. So it would be 250 X $9 = $2,250.

In summary,as it relates to property taxes, a mill is one-tenth of one percent of your taxable value, and your taxable value is either 4.5% (residential) or 5% of your true and full value, also known as "market value."

*The UND Medical School receives one mill from every property tax payer. This is the only property tax assessed by the state.